New Macroeconomics Book Dedicated to Professor Fred Joutz

KAPSARC published a book dedicated to Professor Fred Joutz’s memory: A Macroeconometric Model for Saudi Arabia.

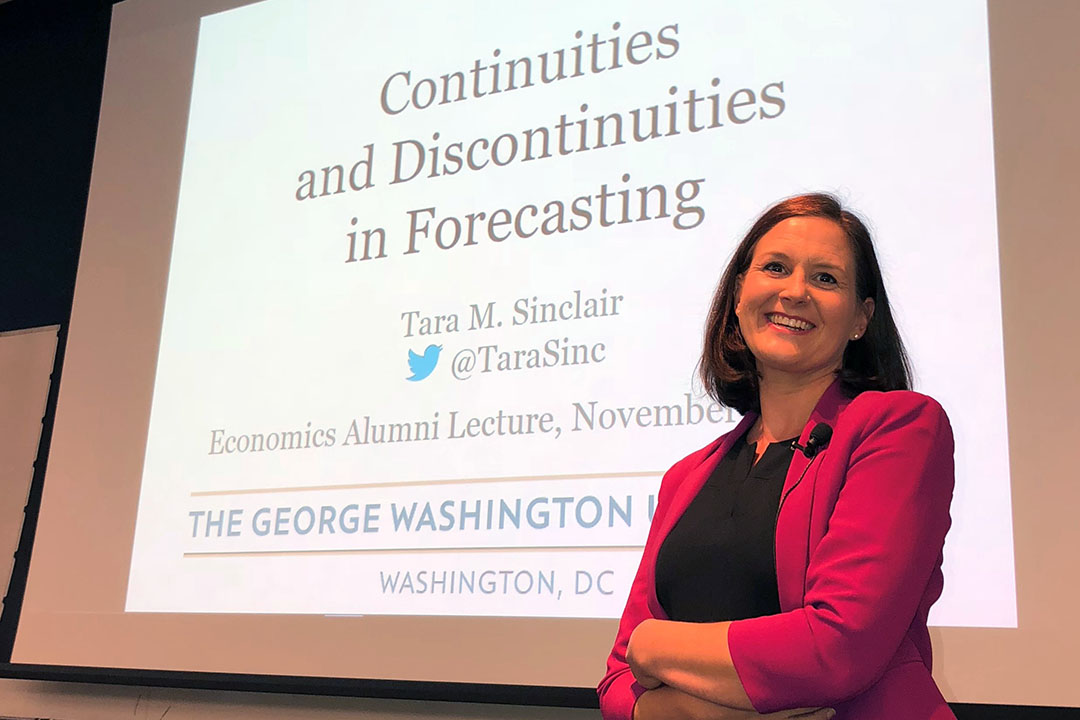

The George Washington University’s Center for Economic Research (CER) brings together leading minds in economics and forecasting. Our scholars advance public understanding through crucial research, including work with the U.S. Bureau of Labor Statistics evaluating their employment projections, the U.S. Energy Information Administration to forecast trends and the U.S. Environmental Protection Agency to analyze the relationship between electricity consumption and climate change.

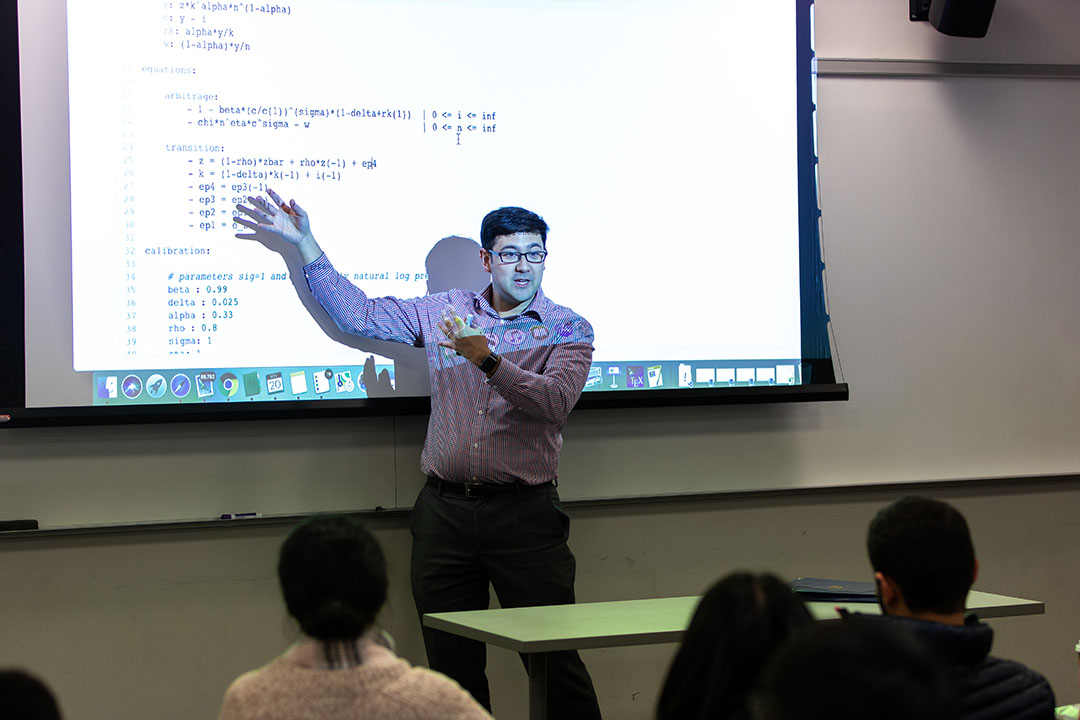

The Center for Economic Research’s primary research entity is the H.O. Stekler Research Program on Forecasting, which supports research, teaching and dissertation supervision in forecasting.

The H.O. Stekler Research Program on Forecasting facilitates a wide range of research projects that require economic data and analysis. We host frequent virtual and in-person events to educate the public, as well as serve as the academic partner to the Federal Forecasters Consortium.

The program also plays a major role in the training of MA and PhD students in economics and other disciplines that require economic data in their research. We have undergraduate and graduate student members in our program and offer the competitive Stekler Fellowship for undergraduate students to get involved in our program and gain experience in research on forecasting.

New Macroeconomics Book Dedicated to Professor Fred Joutz

KAPSARC published a book dedicated to Professor Fred Joutz’s memory: A Macroeconometric Model for Saudi Arabia.